The State of Video Consumption

In the past, many digital briefs allocated a 10% budget towards innovation, first to market and experimental objectives. Although this is still the case in some instances, uncertainty in the market due to Brexit, trust in the media landscape and a general tightening of the belts, has resulted in a shift in strategy and budgets with a swing back established media.

The scale of the reach of TV speaks for itself. TAM Ireland research shows that commercial channels reached 82% of ABC1s in Jan 2019. HKWK currently watch just over 3 hours a day of linear TV, 75% of which was live. In fact, live viewing massively dominates across age and demos. All audiences consume well above 75% of linear TV consumption live and the remaining 25% is time shifted within 7 days. This is not news, it simply reaffirms that TV itself consumes an enormous amount of everyone’s day.

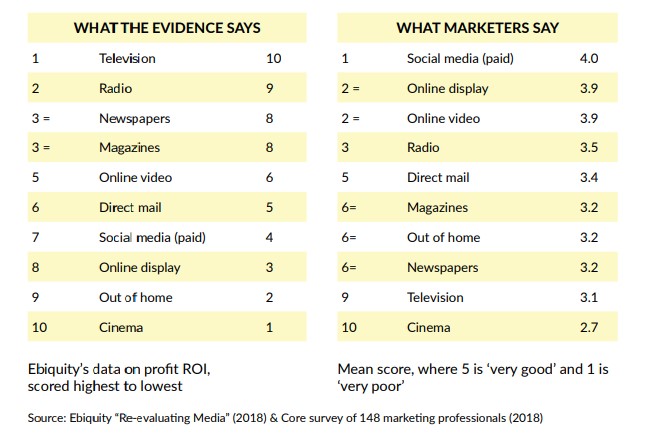

Not to ignore the exciting and bright future of non-broadcast video advertising, in 2016, Mark Zuckerberg predicted that Facebook will be mostly video within 5 years. Advertising budgets have been extremely favourable to Social Media, Online Display and Online Video, seeing Facebook’s global revenue growth +35% last year. The differences are astounding. Core recently conducted a survey to query media planners’ perceptions of effective media and layered these scores against Ebiquity’s ‘Re-evaluating Media’.

However, the buzz is around social and non-broadcast media – and there appears to be a divide between what media planners think and what produces return on investment for advertisers.

However, the buzz is around social and non-broadcast media – and there appears to be a divide between what media planners think and what produces return on investment for advertisers.

RTÉ completes in TV, radio and digital arenas and has always sought to ensure that through empirical studies to prove its value. Further to this, RTÉ carried out an in-depth advertising effectiveness study with Neuro-Insights, a UK neuroscience-based market research company. This study looked at the impact of quality of channel environment and platform on advertising effectiveness. Research respondents were exposed to AV and audio content, including advertising, across several channels. While watching or listening to the adverts, the respondents' brain activity was measured.

Several ads across a variety of sectors (i.e.: retail, insurance, financial services, motors, drinks, cosmetics, utilities and FMCG) were used in this study.

The intent was not to test the creative of these adverts but rather, look at differences in respondent reactions and what adverts encode into memory across different channels and platforms.

Results from the study have shown that TV drives better recall and builds brand affinity. When we look at advertising, we can see that the strong response to programming carries through to the advert breaks. So, environment plays a huge factor in where adverts are placed and how audiences either lean in or withdraw from the advert. RTÉ also conducted a piece of research around ‘Clutter’. The headlines surmising that adverts are more readily recalled in a less cluttered ad-break. Fewer ads, yields a higher recall. Have a read of that here if you haven’t already. There is a huge amount of research and ‘the science bit’ to back this up.

On Thursday 16th May we will be hosting a webinar event on our recent neuroscience research. To register for this webinar simply click 'Register' below.